Launching a startup is an exhilarating experience with a horizon filled with potential. However, this journey comes with its fair share of hurdles, with financial planning standing out as a critical pillar for success. Effective financial planning steers a startup through uncertainties, secures necessary funding, and paves the way for sustainable growth.

Why Financial Planning is Critical

The benefits of robust financial planning include:

- Informed Decision Making: It’s the backbone that supports all major business decisions, from routine operations to strategic expansions. A well-crafted financial plan provides a clear picture of the company’s financial status, helping entrepreneurs make informed choices about investments, hiring, and market expansion.

- Access to Funding: Most startups require an infusion of capital at some point. A detailed financial plan not only outlines the path to profitability but also assures potential investors or lenders of the startup’s financial foresight and stability.

- Cash Flow Control: One of the vital components of financial planning is managing the inflow and outflow of cash. Effective cash flow management ensures that a startup remains solvent, avoiding the common pitfall of running out of funds.

Key Financial Challenges for Startups

Navigating financial hurdles is a tough but crucial aspect of running a new business. The challenges are many, but key among them are:

- Securing Capital: Without adequate funding, a startup’s journey can be cut short. Approximately 38% of startups fail because they cannot gather the necessary financial backing to sustain their operations.

- Managing Cash Flow: A staggering 82% of business failures can be attributed to poor cash flow management, highlighting the need for vigilant financial oversight.

- Underestimating Costs: Many startups falter under financial strain because they underestimate operational costs, with nearly 29% exhausting their funds before turning a profit.

Budgeting and Cost Management

Creating a Startup Budget: A Step-by-step Guide

The next thing we’re going to discuss is how to create a realistic budget for your startup. Here’s a simplified approach:

- Gather Financial Information: Start with collecting all your financial statements, including balance sheets, income statements, and cash flow statements. This will give you a clear picture of your current financial health.

- List All Startup Costs: Begin by listing down every cost associated with starting your business. This includes both one-time costs like equipment and ongoing expenses such as rent and salaries.

- Classify Costs: Distinguish between fixed costs (like rent and salaries) and variable costs (such as marketing expenses and raw materials). Understanding these costs helps in managing them more effectively.

- Estimate Monthly Revenue: While you may not have sales yet, use market research to project your revenue. Consider factors like competitor sales and industry trends to make informed estimates.

- Calculate and Adjust: Subtract your total expenses from your expected revenue to see if your business can sustain itself financially. Adjust your budget as needed to ensure financial stability.

This process involves thorough planning and regular revisions to stay on track and manage your cash flow effectively.

Cost Management Strategies

Shifting our focus from budget creation to cost management strategies, it’s crucial to optimize every dollar spent to fuel growth without draining resources. Here’s how startups can keep their costs in check while scaling up:

- Leverage Technology: Adopting technology not only enhances efficiency but also reduces costs over time. For instance, cloud-based solutions can lower IT expenses significantly, and automation tools can reduce the need for manual labor, which cuts down on payroll costs. Recent studies suggest that startups that invest in technology early can save up to 30% in operational costs within the first year.

- Outsource Non-Core Activities: For many startups, outsourcing tasks such as customer service, IT management, or HR functions can be more cost-effective than managing them in-house. This approach allows startups to focus their efforts and resources on core business functions that drive revenue.

- Negotiate with Suppliers: Strong negotiation can lead to lower costs for goods and services. By securing better terms or bulk pricing, startups can significantly decrease their cost of goods sold. It’s reported that startups that actively engage in supplier negotiations save an average of 15-20% on supply costs.

- Implement Strict Spending Controls: Tight control over expenses ensures that startups do not overspend. Utilizing budgeting tools and regular financial reviews can help identify areas where spending can be cut or where allocation needs to be adjusted. Data shows that startups with strict financial controls tend to extend their runway by 25% more than those without.

- Adopt Lean Practices: Implementing lean methodologies can help startups eliminate waste and increase process efficiency, leading to substantial cost savings. For example, minimizing product defects can reduce the need for returns and repairs, which in turn conserves resources.

Building Financial Resilience

Let’s now explore how startups can build financial resilience to safeguard against uncertainties and foster sustainable growth:

- Regular Financial Reviews Regular financial audits are crucial for maintaining a healthy financial status. By reviewing financial statements and budgets periodically, startups can ensure they are on track with their financial goals and make necessary adjustments to spending or strategy. For example, a quarterly financial review could highlight areas where costs can be optimized, leading to significant savings.

- Diversifying Revenue Streams Diversification is key to reducing risk and stabilizing income. Startups should consider exploring various revenue models and channels to minimize dependence on a single source of income. This could involve introducing new products or services, entering different markets, or leveraging different pricing strategies to attract a broader customer base.

- Maintaining Good Credit Good credit is essential for accessing better financing options. Startups need to manage their finances diligently, ensuring bills and loans are paid on time and keeping credit utilization low. Regular checks on credit reports are advisable to correct any inaccuracies that might affect credit scores. This diligence helps in securing loans at favorable rates and attracting potential investors.

- Educating the Team on Financial Goals Involving the entire team in understanding the financial goals of the startup can lead to more informed and responsible decision-making across the board. Educational initiatives on budget management and the financial impact of departmental decisions empower employees to contribute positively to the company’s financial health. For example, a marketing team aware of budget constraints might opt for more cost-effective promotional activities that yield a higher return on investment.

- Strategic Financial Planning: Effective financial planning is crucial for managing growth and resources efficiently. Data from the Financial Planning Association shows that startups with dedicated financial plans report a 20% higher growth rate compared to those without.

Planning for Growth

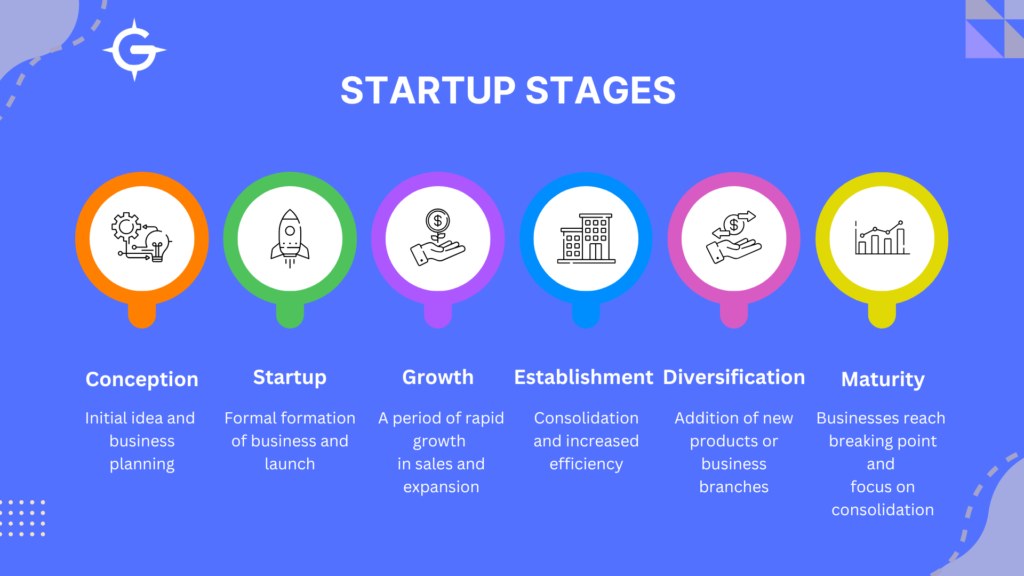

As startups progress through their development phases, understanding the typical stages can provide a framework for planning their growth and financial management. These stages generally include:

- Seed and Development: This initial stage is where the business concept is fleshed out, and the groundwork for future operations is laid.

- Startup Stage: At this point, the business begins operations. Early revenue streams may be developed, and the product or service is introduced to the market.

- Growth and Establishment: The business experiences more rapid growth during this stage, which requires careful management to sustain and support further expansion.

- Expansion Stage: This stage involves entering new markets and increasing the product range. The company may also start to consider acquisitions.

- Maturity and Possible Exit: As the business matures, operations can stabilize, and owners may look toward exit strategies, such as selling the business or scaling down operations.

With these stages in mind, let’s delve into the specifics of long-term financial planning, investment management, and measuring financial health:

- Long-Term Financial Strategies: Developing robust financial frameworks that support scalability is crucial. Clear, long-term financial goals and strategies should be established to facilitate entering new markets, diversifying product lines, or acquiring strategic partners. According to KPMG, companies with well-defined long-term strategies tend to outperform their peers, achieving up to 25% higher revenue growth and profitability.

- Investment Management: Managing investments effectively is key to maximizing returns and supporting expansion. This involves not only securing funding but also strategically allocating it to the areas with the highest growth potential. PwC reports that startups employing dynamic investment strategies based on regular market analysis see a 30% higher return on investment compared to those with static strategies.

- Measuring Financial Health: It is vital to regularly assess financial health through key performance indicators such as cash flow, profit margins, and revenue growth. Utilizing tools and systems that provide real-time financial data enables startups to make informed decisions quickly. Bain & Company highlights that startups using advanced analytics for financial monitoring can enhance their decision-making speed and accuracy by over 35%.

Risk Management and Mitigation for Startups

In startup risk management, the excitement of launching a tech startup is often accompanied by significant risks, which require planning and proactive measures. Importantly, 63% of startups implement some form of risk management strategy from the outset, which is essential for their longevity and eventual success.

Here are some specific risk considerations and mitigation strategies for startups:

Identifying Potential Financial Risks

- Assess Market Demand and Viability: Conduct thorough market research to verify a real need for your product before making significant investments. This ensures there’s a target audience ready to engage with your offering.

- Monitor Financial Stability: Regularly track your financial health using key performance indicators like cash flow and profit margins. This active monitoring helps you manage financial risks effectively.

- Ensure Regulatory Compliance: Comply with all relevant regulations, especially in sectors like fintech or health tech, to avoid legal issues that could disrupt your startup’s progress.

- Stay Updated with Technological Changes: Keep your product or service competitive and relevant by integrating the latest technological advancements.

- Protect Against Cybersecurity Threats: Since 58% of risk executives identify cybercrime as a top risk, prioritize safeguarding your data and systems to prevent breaches that could lead to severe financial and reputational damage.

Strategies for Risk Mitigation

- Develop a Flexible Business Model: Adapt your business model to feedback and market changes to reduce the risk of failure.

- Explore Diversified Funding Sources: Seek various funding options such as angel investors, crowdfunding, and grants to enhance financial security beyond traditional venture capital.

- Implement Operational Excellence: Establish strong internal controls and processes to minimize risks associated with human error and operational failures.

- Secure Insurance and Legal Safeguards: Obtain adequate insurance coverage and develop sound legal strategies to protect against potential lawsuits and financial losses.

- Develop Comprehensive Contingency Plans: Create detailed business continuity and disaster recovery plans to ensure your startup can withstand unexpected disruptions.

Accessing Startup Resources

Accessing the right resources is essential for startup success. Here’s a breakdown of various types of funding and other resources that can help startups thrive:

Understanding Different Types of Funding

Bootstrapping vs. External Funding

Bootstrapping

Bootstrapping involves self-funding your startup using personal savings or revenue generated from the business. This method allows for full control but may limit growth potential due to resource constraints. Resources for bootstrapping include:

- Personal Savings: Using savings accounts or personal investments.

- Revenue from Existing Businesses: If applicable, using profits from another venture to fund the startup.

- Credit Cards: Utilizing credit for initial expenses, though this can carry high-interest rates.

- Peer-to-Peer Lending Platforms: Peer-to-peer (P2P) lending allows individuals to borrow money directly from other individuals through online platforms. Here are some notable P2P lending platforms:

- LendingClub: One of the largest P2P lending platforms, offering personal loans that can be used for business purposes.

- Prosper: Another major platform that connects borrowers with individual investors.

- Funding Circle: Specifically focuses on small business loans, connecting businesses with investors who want to fund them.

- Upstart: Uses AI to assess creditworthiness and offers personal loans that can be used for business funding.

- StreetShares: A platform that caters specifically to veterans and offers small business loans and lines of credit.

- Factoring as a Funding Source: Factoring involves selling your accounts receivable (invoices) to a third party (a factor) at a discount in exchange for immediate cash. This can be a useful option for startups that have outstanding invoices but need cash flow to continue operations. It allows businesses to receive funds quickly without incurring debt.

External Funding

External funding for startups involves raising capital from sources outside of the company’s current financial resources. This can be a vital step for startups looking to scale quickly and access resources they otherwise wouldn’t be able to afford. Here’s more detailed information about the nature of external funding:

Equity Financing

Equity financing involves raising capital through the sale of shares in the company. This means investors provide funding in exchange for ownership rights or a stake in the company. The key benefit is that unlike a loan, there’s no obligation to repay the funds. However, equity financing means sharing control of the company with investors, who may have a say in business decisions. We have two primary sources of equity financing in this category namely:

- Angel Investors: These are typically affluent individuals who provide capital to startups at the earliest stages. They may invest in exchange for convertible debt or ownership equity. Angel investors are particularly valuable due to their willingness to invest when the venture is still in its nascent stages and because they often bring both capital and mentorship to the startup.

- Venture Capital (VC): Venture capitalists are firms or individuals who invest in startups displaying high growth potential in exchange for equity. VCs usually come into play after the initial stages, providing larger amounts of capital than most angel investors in order to scale the business rapidly. This investment comes with a share of ownership and sometimes a role in company governance.

Debt Financing

Debt financing means borrowing money that must be paid back over time with interest. This method does not dilute company ownership, as lenders do not receive an equity stake. The primary advantage is maintaining control over the company, but the downside is the obligation to make regular payments regardless of the business’s financial performance, which can strain cash flow. Common sources include:

- Bank Loans: Traditional loans from banks or credit unions.

- Small Business Administration (SBA) Loans: Government-backed loans designed to support small businesses.

- Credit Lines: Revolving credit options from banks that allow businesses to borrow as needed.

Government Grants and Subsidies

These are funds provided by government bodies that do not need to be repaid. Grants are often awarded based on innovation, research potential, or growth in specific industries. They can be pivotal for research-heavy startups or those in industries like technology, education, or health. Some of them include:

- Grants.gov: A comprehensive database of U.S. federal government grants available for various sectors, including technology and healthcare.

- Canada Business Network: Offers information on grants and funding opportunities available in Canada.

- Local Economic Development Offices: Many municipalities offer grants or incentives to encourage local business growth.

Incubators and Accelerators

- Incubators: Provide startups with workspace, mentorship, and access to a network of investors and industry experts, usually without taking equity. They are geared towards nurturing businesses over a longer period to help them become stable and self-sufficient.

- Accelerators: These are intensive, short-term programs that include mentorship and educational components, culminating in a public pitch event or demo day to accelerate growth. They often take equity in exchange for capital and resources.

The following are examples of these incubator and accelerator programs:

1. 500 Startups

- Overview: A global venture capital firm and startup accelerator that provides funding, mentorship, and a network of resources to early-stage companies.

- Focus Areas: Technology startups across various sectors.

- Website: 500 Startups

2. Y-Combinator

- Overview: Y Combinator (YC) is an American technology startup accelerator and venture capital firm launched in March 2005, which has been used to launch more than 4,000 companies.

- Website: Y Combinator

3. Seedcamp

- Overview: A European seed fund that invests early in world-class founders tackling large markets.

- Focus Areas: Technology and digital startups.

- Website: Seedcamp

4. MassChallenge

- Overview: A non-profit accelerator that supports high-impact startups through mentorship and networking without taking equity.

- Focus Areas: Various industries including health, technology, and social impact.

- Website: MassChallenge

5. Plug and Play Tech Center

- Overview: A global innovation platform connecting startups with corporations and investors to accelerate growth.

- Focus Areas: Various sectors including fintech, health, retail, and more.

- Website: Plug and Play

6. Startupbootcamp

- Overview: A global network of industry-focused startup accelerators that provides mentorship and funding to startups.

- Focus Areas: Various industries including fintech, health tech, and smart cities.

- Website: Startupbootcamp

7. The Founder Institute

- Overview: An early-stage startup accelerator that helps entrepreneurs launch their companies through structured programs.

- Focus Areas: Diverse sectors with a focus on tech startups.

- Website: Founder Institute

8. HAX

- Overview: A hardware accelerator supporting startups developing physical products with funding and mentorship.

- Focus Areas: Hardware startups across various industries.

- Website: HAX

9. Blue Startups

- Overview: An accelerator based in Hawaii focusing on technology companies with an emphasis on the Asia-Pacific market.

- Focus Areas: Technology-driven startups looking to scale globally.

- Website: Blue Startups

There are also local incubators which often provide tailored support based on regional needs or specific sectors. Here are some examples:

1. TechNexus

- Location: Chicago, Illinois

- Overview: An innovation center that connects startups with corporate partners for collaboration and growth.

2. CIC (Cambridge Innovation Center)

- Location: Multiple locations including Cambridge, Massachusetts

- Overview: Offers coworking space, networking opportunities, and resources for startups.

3. The Venture Center

- Location: Little Rock, Arkansas

- Overview: Focuses on fintech startups by providing mentorship, training, and access to investors.

4. The Innovation Hub

- Location: Little Rock, Arkansas

- Overview: Provides resources for entrepreneurs including workshops, networking events, and access to funding.

These accelerators and incubators offer valuable resources for startups looking to grow their businesses through mentorship, funding opportunities, and networking within their respective industries. Each program has its unique strengths and focus areas, so entrepreneurs should carefully consider which aligns best with their business goals.

We hope these tips and resources empower your startup to navigate the financial complexities of the entrepreneurial world. With only about 1% of startups securing venture capital funding, understanding and managing your finances effectively is more crucial than ever

For personalized guidance and expert advice, consider partnering with GuidPro Consulting. We’re here to help you develop a strong financial foundation and strategic growth plan tailored to your unique business needs. Reach out to us today and take a proactive step toward securing your startup’s future.